Future of mobility — Scenario 3: Autonomous vehicle takeover

What if privately owned autonomous vehicles (AVs) took over and were able to communicate with enhanced privatized infrastructure and other vehicles? In this scenario, private level 4 autonomous vehicles are available for private use and are first introduced into the premium segments of the market with a big price tag.

Scenario breakdown

This scenario is a technotopic vision of an advanced, corporate-funded infrastructure, leading to automotive companies governing the mobility sector, and the software market for automotive manufacturers skyrocketing in Europe.

Advanced artificial intelligence (AI) and various regulations related to it have enabled the nascent development of a market for private autonomous vehicles. Simultaneously, the European Hydrogen Backbone initiative has established a continental hydrogen pipeline system, and multiple battery gigafactories have been built in several EU countries.

This, combined with corporate investments in the expansion of charging station networks in both public and private spaces, has enabled alternative propulsion technologies (e.g. battery electric vehicles for passenger transport and hydrogen fuel cells for logistics) to take the lead. Internal combustion engine vehicles were no longer manufactured after 2030, but they still make up a significant part of the overall mobility stock.

The application of AI, not just within the car but across the whole production and manufacturing process – has enabled carmakers to reduce costs and increase profits, enabling them to maintain their powerful position within transportation systems, accompanied by energy and tech companies.

Battery electric vehicles have become a central mode of transportation, and for the most part, they are still owned privately and not shared. The introduction of autonomous vehicles into the mass market was a major game changer. It led to the emergence of entirely new service ecosystems in mobility as AVs can collect and share far more data than their predecessors in 2023, and at the same time, passengers can engage in more activities during their journey than before.

Even public infrastructure has become partially privatized as carmakers, energy and tech companies have started to collectively invest in its expansion. The infrastructure has been augmented with smart technology, so communication between individual vehicles (vehicle-to-vehicle, V2V) or between vehicles and different types of infrastructure and other assets (V2X) is widespread. As a result, many payments happen automatically and silently in the background since it’s possible to track wherever the car is going and at what speed – though only the newest models can use this asset. It has led to significant variation in how people of different social status move through the cities.

Autonomous vehicles in 2040 are still considered a luxury for the wealthy, and people with less income have to rely on stagnating public transport. While the first phase of connected vehicles was accompanied by some hiccups – such as lack of connection coverage, compatibility, and hacking attacks – the industry has overcome these issues. The EU’s CAR 2 CAR communication consortium played a major role in establishing data and communication protocol standards.

Scenario prototype

Our scenario analysis suggests that the introduction of privately owned, non-shared autonomous vehicles – if not shared – could potentially worsen the space challenges we face in cities today, as many cars remain parked for approximately 90% of the time.

So what would it take to overcome these challenges? Approaches around sharing autonomous vehicles are essential to solving these problems. When not in use, cars could be used to transport other people, deliver packages or feed energy into the grid. Not only would this help solve the biggest obstacles to mobility, but it would also create new revenue models for car owners.

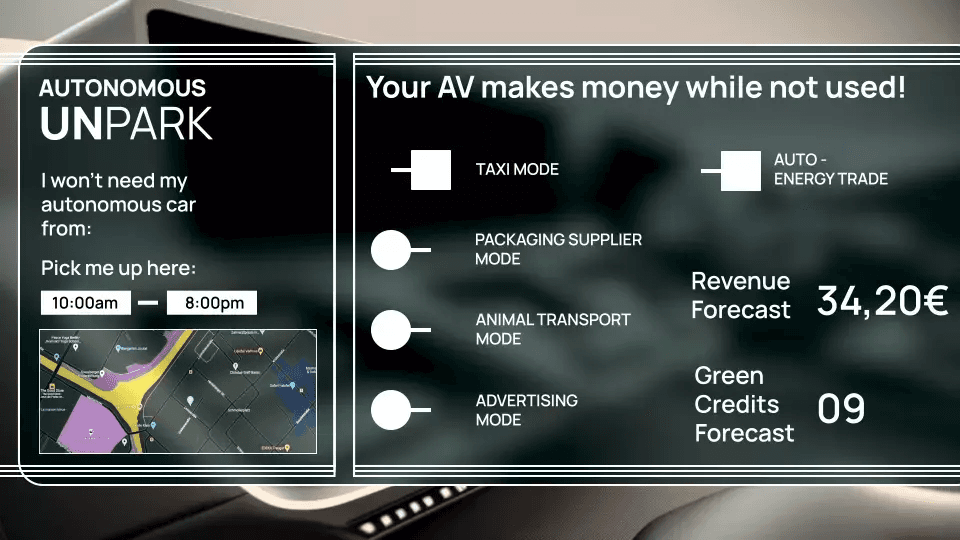

"Autonomous UNPARK" is a fictitious service application for autonomous cars. It offers potential new revenue streams for the car owner by allowing the vehicle to perform various services when not in use. The car can transport people, deliver goods, display advertising or supply electricity. Before leaving the car, the owner can choose which services the car will perform in their absence. Based on the duration and selected modes, the application can provide a rough revenue forecast. In addition, green credits (bonus tokens for discounts) are offered based on the environmental impact of the owner's choice.

Emerging e-mobility infrastructure

A rapid expansion of charging infrastructure is needed to enable the switch from fossil fuels cars to electrically powered cars.

Critical infrastructure security

Smart, connected infrastucture requires increased security and protecting critical systems from malicious actors.

Currencies redefined

Money is replaced by and supplemented with new types of currencies, such as attention, trust or digital currencies.

Reversed globalization

In the wake of global pandemics, resource scarcities and new wars, key supply chains are partially collapsing and being transformed.

AI as a customer

Passengers can get comfortable and enjoy the trip while artificial intelligence (AI) takes care of driving to the destination as well as paying for any necessary services and fees such as road tolls.

The future city is an orchestra

Electrified mobility is one of the biggest changes we face in the coming years. It will also make sound an integral part of all design.

Data-enabled traffic

Combining processes based on data and algorithms with 5G and 6G connections can improve urban planning and traffic coordination.