CXC 2017 Key Note Speech: Are We Getting It All Wrong?

Current thinking on Customer Experience in Financial Services has the right intentions but the wrong emphasis says Futurice Global Principal, Advisory John Oswald. Here are the highlights of John’s key note speech to the CXC Customer Experience Conference 2017.

"In an uncertain world, there is one certainty everyone here can agree on: delivering outstanding CX is ridiculously challenging within our highly regulated financial services sector. But more necessary than ever.

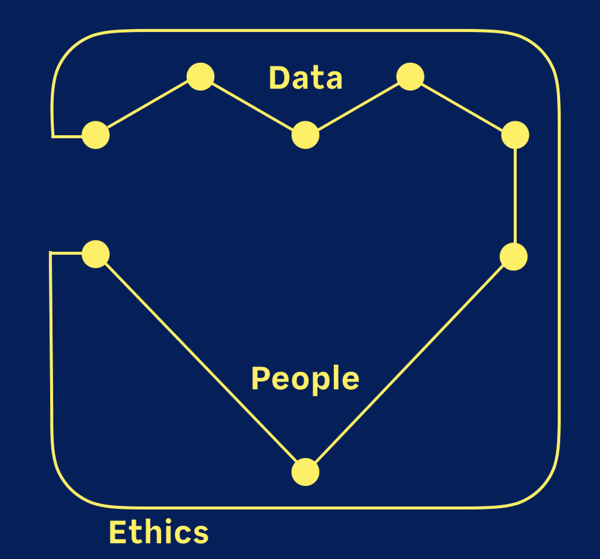

That said, given the ongoing disconnect between what financial services brands say about themselves and customers’ day-to-day experiences of banks, are we sure that the prevailing approach to customer experience – with its emphasis on data, marketing, channel strategy, technology and analytics - is the right one?

Does CX in your organisation get left to the data guys? Maybe it’s viewed as a customer service issue and measured through customer surveys? Alternatively, does it get handed to the tech people to develop a tech solution?

Lots of progress is being made across different organisations - we’ve seen NPS uplift of 20-40%, lifetime value increasing, better ‘engagement’. But, the general approach feels like it’s getting a little “cookie-cutter.”

It’s all about NPS plus better CRM plus personalised, targeted marketing. Great, but I think this approach to customer experience fundamentally misses the point. Customer experience isn’t the responsibility of data or marketing, it’s a cross-silo objective, a cultural phenomenon. Ultimately, it’s a human thing, with all the chaos and unpredictability that this implies.

Customer experience is all about helping people engage better with their world. Money is an important part of our world and financial services CX therefore has a vital mission to help consumers engage with money.

So, what might an alternative manifesto for outstanding CX look like? I have come up with five principles that could help inform a radically different approach to CX, and I’m looking forward to building on these at events and via debate over the coming months

1. Find (and Remember) the Human

From exposure to 4,000 -10,000 ad messages a day, to checking our phones 1500 times a week, we consumers have ever increasing claims on our time. Outstanding financial services CX should avoid adding to the noise and aim to be attention saving rather than attention claiming, a phrase I’m borrowing from Trendwatchers. A key focus needs to be on finding ways to quietly solve consumers’ pain points or problems in the background, whether it’s savings app Digit working out how much consumers can afford to save each day then automatically transferring that amount into their savings account, or Czech bank brand Air Bank piloting a NFC-enabled contactless cash withdrawal system allowing consumers to withdraw cash from ATMs without inserting their cards.

There’s a lot that Financial Services can learn from other sectors about finding and remembering the human and effortlessly removing their pain points. Futurice recently partnered with Finnair, airport services provider Finavia, to design a prototype for the world’s first face recognition check-in desk system at Helsinki Airport. The trial, carried out earlier this year, aimed to explore how to reduce the pain points involved in producing ID at airport check-in desks, by allowing one thousand Finnair frequent flyers to upload their photo via a dedicated test app before arriving at the airport. When arriving for their flights, the customers used a designated check-in desk where face recognition technology meant check-in staff could recognise and greet them by name, without the need to produce any documents.

Could a similar system be used to verify customers’ ID in bank branches, thus removing a small pain point from the process? These interventions soon add up and become real ways to save people’s attention.

And let’s not forget the ‘remember’ part of this principle - when we translate insights about customers into technology, we need to retain the vision and not just commission another bunch of IT platforms.

2. View Fintech Disruptors as Space Probes

Until now, the narrative around Fintech start-ups has tended to portray them as the big disruptors of established financial services brands. What would happen if, instead, the financial services sector viewed them as Space Probes, helping us find where the real customers’ pain points and the jobs to be done really are? Fintechs are usually solving interesting consumer problems. Take student debt, which is a growing issue facing workforces globally. In the US, CommonBond has taken a fresh approach to the problem of student debt by providing a platform that enables employers to refinance the loans of high calibre grads they want to hire. Meanwhile US peer-to-peer loan service Lending Club removes the fear around applying for credit, by allowing consumers to check the interest rate they could get for a loan, without impacting their credit score.

Ongoing, constructive dialogue and partnership with as many interesting companies and Fintechs as possible - that sounds like a good recipe for spotting great improvements in CX in financial services. It also builds on the ‘find the human’ point earlier.

3. We’re All in This Together

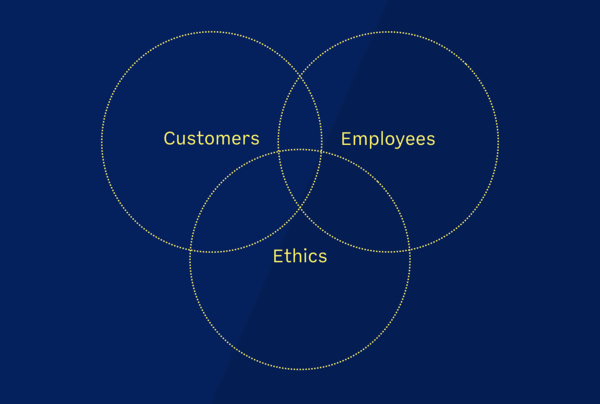

It’s easy to be seduced by beautifully designed customer experiences and apps. However, as companies like Uber are painfully discovering, customer experience needs to be sustainable. This means remembering that customers, employees and ethics intersect and that delivering a great customer experience must not come at the expense of a great employee experience. We are all in this together and the brands that deliver best in class customer experiences must be similarly ambitious when it comes to ensuring and delivering a great employee experience. Customer experience isn’t purely a customer facing mission - people are our greatest assets, here to deliver it in the first place.

4. Customer Experience is A Cultural Thing

Delivering great customer experience is a cultural phenomenon that cuts across siloes and hierarchies. It’s hard to imagine a great customer experience emerging from companies where employees work in cubicles or where sticking things on the walls is banned, or where some people haven’t even been to the other floors in their building. The mindset and methods required to deliver stand out customer experience include co-creation, experimentation and permission to fail. It’s hard to understate the importance of this cultural element. Each initiative to improve CX needs to be accompanied by organisational evolution - taking our own people on their journey, not leaving it to suppliers. Ensuring we’re making our very organisations future capable with a new set of values and practices.

At Futurice, we focus a large amount on what we call ‘lean service creation’ - a mindset of collaborative problem solving using a series of canvases. It’s not the canvas itself that counts; it’s more the ability to bring people together to align and collectively move forward

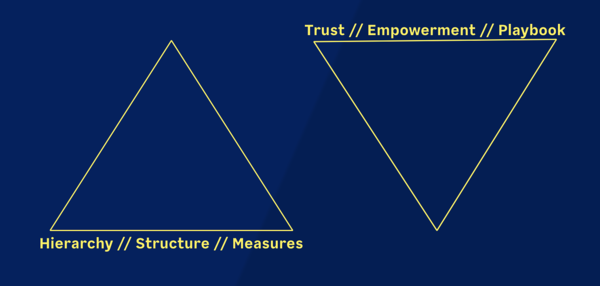

5. Focus on Playbooks Not Metrics

Rather than metrics which are geared to linear process and hierarchy, delivering great CX should focus on playbooks: a blend of business process workflows, standard operating procedures and cultural values. These offer a much more flexible way of managing and evaluating the messy and human nature of CX. One characteristic of successful playbooks is a tendency to invert the traditional hierarchical approach to decision making and empower people on the front line to make decisions. The rationale for this “inverted pyramid” approach is that front line employees are usually closest to the action and have the necessary information to make the right “front line” decision. Companies with great CX playbooks include Spotify with its “limited blast radius” approach to innovation which empowers teams to experiment and fail but deploys a decoupled architecture to lower the cost and impact of failure.

Meanwhile at Zappos, which is famed for outstanding customer service, customer service reps are trusted to make decisions on how to handle calls - they don’t follow a set script or refer complex decisions higher up. At my company, Futurice, everyone has the power to make good, transparent and fair decisions. To help support that, our 3 x 2 philosophy (now 4x2) provides a framework for empowering decision-making at all levels in the company. When moving towards a decision, a new project or an outsourcing task, we ask our people to consider three (3) times two (2) factors: how does the decision affect your colleagues, the customer and the numbers, now and in the future?

To sum it all up, to achieve standout customer experience instead of emphasizing data, marketing, channel strategy, technology and analytics, think humans, probes, togetherness, culture, and playbooks. Your customers and your people will thank you for it.”

John OswaldGlobal Principal, Advisory Team

John OswaldGlobal Principal, Advisory Team